Anarchy in the USA

“How did you go bankrupt?"

“Two ways. Gradually, then suddenly.”

Ernest Hemingway, ‘The Sun Also Rises’

There have been many dark days in the US over the past four years, but Wednesday was one of the darkest. The ongoing degradation of US political institutions was crystallised in shocking form, as Mr Trump incited the storming of the US Capitol to stop the certification of the Presidential election results.

The past four years have seen a substantial erosion of US institutions and norms. It would be wrong to attribute all of this to Mr Trump. Social and political divisions and polarisation have been worsening for decades.

But Mr Trump has worsened these weaknesses in ways that have exceeded the expectations of almost everyone. And over the past several weeks – and again on Wednesday – he poured fuel on the fire.

Of course, the US is resilient – and has recovered from previous domestic crises. I was living in the US during the Clinton impeachment and the contested Bush/Gore Presidential election – both highly charged and partisan processes. But this is at a different level.

Immediate polls reported that just under half of Republicans believed that the events on Capitol Hill were justified. And 56% of all respondents believed that fraud led to the election of President Biden. A remarkable 35% of Republicans blamed Mr Biden for the riots. The argument that Wednesday’s events will have a unifying effect seems optimistic. These divisions make the US increasingly dysfunctional.

Institutions matter

Strong political and social institutions are central to strong national outcomes, as I have noted previously: the absence of corruption, high levels of trust in institutions, social capital, effective governance. One of the core reasons for small advanced economy success is that they have strong institutions.

Weak institutions create exposures. A canonical example is Argentina, one of the richest countries in the world in the late C19 – but which declined over the subsequent century, plagued by social and economic crises due to institutional weakness. Italy is another example.

The US is not at these levels. But its ability to address structural policy issues has been deeply compromised. The US has world-leading strengths in many areas, including great companies and universities, but this is not a sufficient condition for success.

In this political context, it is difficult or impossible to establish a sense of national purpose on priority issues, from infrastructure and strategic technology investment to fiscal policy and national security strategy. And the US has little apparent ability to deal with policy challenges such as declining life expectancy and weak educational outcomes.

In the near term, the Democrats have won control of the Senate – which makes the confirmation process and the immediate policy agenda of the Biden Administration much easier to secure. Done well (fiscal, infrastructure, clean energy, the Covid response) this will give the US some immediate momentum; US equities responded positively to the Georgia results.

There may be more space for bipartisan policy on some issues, and Mr Biden is perhaps uniquely well placed to find consensus, but there will still be political limits. And a divided Congress may return in two years.

Around the world

Many countries around the world will welcome the Biden Administration’s greater commitment to multilateral institutions, climate change action, and to working with partners more constructively. But countries from Europe to Asia are reducing their reliance on the US relationship: countries do not see the Trump Administration as an aberration.

US soft power will likely increase from its current lows, but governments are unlikely to see this as structural. Countries are investing in new relationships and building ‘strategic autonomy’.

Warren Buffet once advised ‘never to bet against America’. This has been sound advice historically. And I would still take a bet on the US over China; even flawed democratic systems beat autocracies. But the world has a problem when the two largest national economies - the US and China - both have deep political fragilities.

The global economy is assuming the institutional properties of an emerging market, with higher economic and political risk likely as a result. This will be a bumpier environment for small economies to navigate.

The US as a portfolio of small economies

Resolving these entrenched divisions in the US is a long-term agenda. But much increased policy devolution from DC to state and local government may be a key part of the answer.

The small economy experience shows that better outcomes can be achieved in smaller political units, where there is greater alignment of interests, higher levels of political and social trust, and a greater extent of political accountability. Treating the US as a portfolio of small economies may be an effective way of side-stepping some of the political divisions.

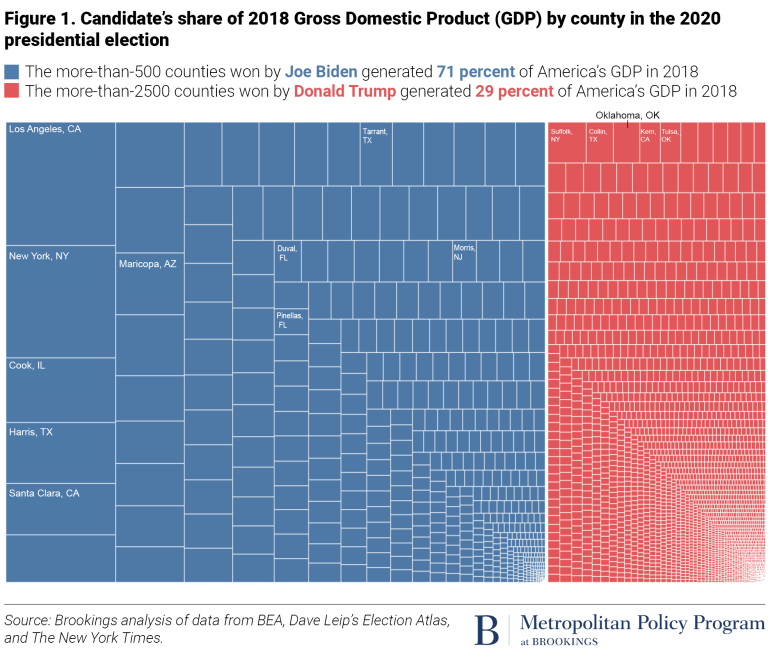

Brookings noted that Mr Biden won in counties that accounted for 71% of US GDP, including most urban areas. This suggests that a policy agenda focused on digital and green investments, which may struggle for passage at federal level, may find more support at state and city level in parts of the US.

Looking forward

This has been a terrible week for the US. Although the pathway to inauguration on January 20 remains clear for Mr Biden, the US has been deeply damaged. This will take time to fix – and will have implications for the functioning of both the US and also the global system. We will all need to adjust to these realities.

Get in touch if you would like to discuss this analysis and its implications. I am also available for presentations and discussions on other global economic and political dynamics, and the implications for policymakers, firms, and investors.

You can subscribe to receive these notes here.

Chart of the week

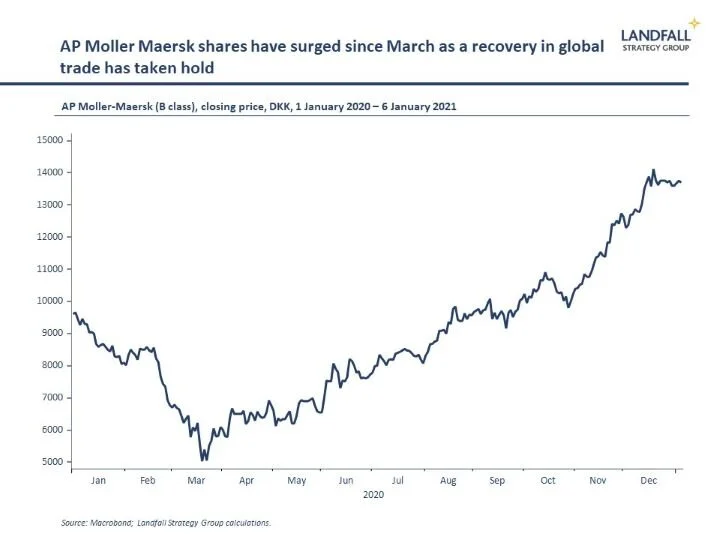

AP Moller-Maersk, the Danish shipping company, is a useful bellwether for the strength of the global economy. Its share price halved between January and March 2020, from around 10,000 DKK to just over 5,000 DKK, but then almost tripled to finish the year at around 14,000 DKK – a return of ~40% for the year, even before dividends. In addition to company intrinsics, this performance reflects the strong recovery in world trade and higher shipping prices (the Shanghai Containerized Freight Index is up 2.5x since March). This is a positive sign for the global economic outlook.

Small economies around the world

Singapore advance GDP estimates for Q4 reported 2.1% qoq growth, for a contraction of 3.8% in the year to Q4. This is a 5.8% contraction yoy for the full calendar year, beating official forecasts. The Ministry of Trade & Industry forecasts GDP growth of 4-6% in 2021.

Israel is leading the world on Covid-19 vaccinations, with over 1.5 million people (16% of its population) now vaccinated. This success in rapid vaccine deployment is largely due to Israel’s strong public health system, and of course Israel has well-developed capabilities in mobilising during a crisis.

Danish borrowers can now take out a 20-year fixed rate mortgage at 0%, a function of loose ECB monetary policy. This will place further upward pressure on Danish house prices, an economy that has already experienced strong house price growth over the past decade.

A thriving tech scene has allowed Uruguay to shine during the pandemic. Uruguay now has its first unicorn (in the payments space) and has also developed a well-regarded Covid app. Uruguay is attracting growing amounts of foreign talent investment – drawn by its skills and innovation capabilities, as well as relative political and social stability.

And Norway’s edtech unicorn Kahoot, familiar to students around the world, is considering an IPO this year. Its share price has almost doubled over the past year on strong demand for online educational tools.

Brexit has now happened, and momentum is growing for a second independence referendum in Scotland. First Minister Nicola Sturgeon has written an op-ed for publication in multiple European newspapers making the case that independence is the way for Scotland to rejoin the EU – a case for which there is significant sympathy in Europe.

The Nordic model continues to attract plaudits, ranked by numerous recent reports as being well positioned for a strong recovery. Many of the Nordic economies have also performed well through the Covid crisis. And their capabilities on digital as well as social insurance position them well for structural adjustment.

Ireland’s closest EU neighbour is now France. And new paperwork requirements and the potential for delays using the UK landbridge to the EU has led to high demand for new direct ferry crossings to France, Belgium and the Netherlands from Ireland.

Changi Airport is a central part of the Singapore economy, which has been hit hard by the collapse in business and leisure travel. The Singapore government – and firms – are working to develop new initiatives at Changi – from new attractions for locals at the airport to socially distanced conference facilities at the airport to attract business travel.

Dr David Skilling

Director, Landfall Strategy Group

www.landfallstrategy.com

www.twitter.com/dskilling