Large economies are becoming small

You can subscribe to receive these notes by email here

It is said that there are two types of countries: small countries, and those that have not yet realised that they are small. But from Italy to the US, recent developments suggest that several large economies are adopting elements of the successful small economy playbook.

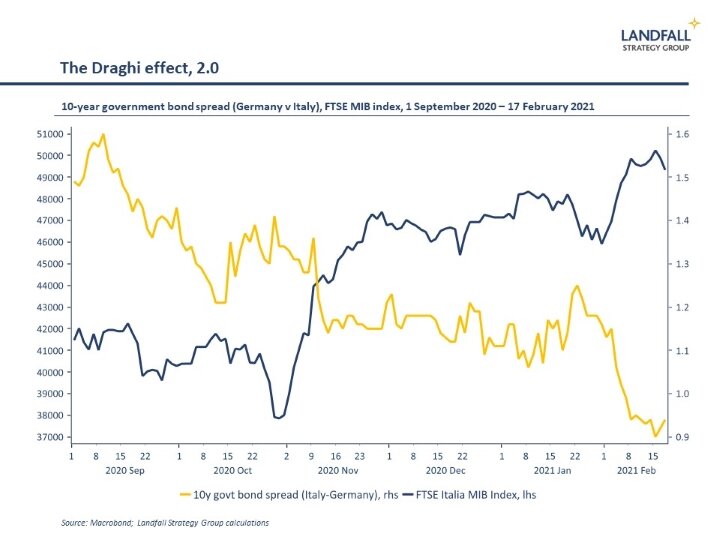

The arrival of Mario Draghi as Italian PM has created a rare sense of confidence in the Italian economic outlook. The man who saved the Eurozone by stating he would do ‘whatever it takes’ will have to repeat the same feat in Italy.

Italy’s problems are well-documented, with sustained weak economic performance. And the current outlook is weak (see chart of the week, below).

Mr Draghi’s immediate focus will be to develop policies to access the EU Recovery Funds: Italy has been allocated over €200b in funding, or ~12% of pre-Covid GDP, including €84b of grants. Announced priorities include digitalisation, the green transition, skills and innovation; reforms of Italy’s legal, tax, and public administration systems; and improvements to the business environment.

As part of the haggling over the EU Recovery Fund last year, small economy ‘frugals’ demanded that governments commit to reforms before they can access these funds. This was driven by the small economy perspective on the importance of policy reform to drive sustained economic improvement.

Countries that take the reform process seriously, such as Italy (and Greece), could come out of this stronger – reducing the gap with the more prosperous, often small, Northern European economies.

And elsewhere

This growing large economy focus on supply side measures can be seen elsewhere. In the US, Janet Yellen – also a former central banker – has taken the reins of the Treasury. Much of the US economic policy debate still revolves around macro policy; there are vigorous debates currently underway about the proposed $1.9 trillion fiscal stimulus.

But beyond this, the Biden Administration is looking to invest substantially to build competitive strength and address domestic issues. The strategic competition with China I discussed recently cannot be won on the basis of tariffs and aircraft carriers. Fundamentally, the strength of the US economy is what will provide the edge.

Domestic and foreign policy are being integrated. Free trade agreements, including the CPTPP are out of favour, which is unfortunate – as is some of the economic nationalism. But there will be scaled-up investments in research and innovation, developing positions in the new commanding heights of the global economy (clean energy, semi-conductors, etc), and so on.

These steps are in the right direction. The US has many strengths, but investment is needed in strengthening infrastructure, educational outcomes, and the innovation pipeline. A supply-side agenda focused on competitiveness needs to be a priority, as often seen in small economies.

In the UK, the success of the post-Brexit economy will depend on whether an effective supply-side strategy can be developed – to sit alongside unprecedented fiscal deficits. There is much talk of levelling up, commitments to research moonshots, the green transition, and ‘global Britain’. But so far there is little concrete evidence of a small economy style strategy of the type needed.

Elsewhere, arguments were made this week that emerging markets are likely to emerge relatively quickly from the Covid crisis because they are engaged in structural reform rather than relying on macro stimulus.

I am more cautious on the strength of convergence by emerging markets as the nature of globalisation changes (see my recent note). But the basic point on the importance of policy reform goes through: loose macro policy is not a sufficient condition for sustained economic performance.

Think small

My assessment is that large economies have become smaller as globalisation and technology have reached further into their domestic economies. A key reason for their relatively sluggish performance (and some of their political problems) is that large economies have not responded directly to these emerging realities in the way that small economies have.

Small economies have a strong record of managing deep exposures to globalisation, generating strong economic outcomes as well as maintaining strong employment rates and a compressed income distribution through deliberate policy.

One of the consistent themes in high-performing small economies is a focus on supply side rather than demand side (macro) policy. Heavy investments are made in skills and innovation, active labour market policy, infrastructure, and a high-quality business environment.

In contrast, large economies have placed emphasis on demand side policy. This will remain important given the depth of the economic and social challenge: creating a ‘high pressure’ economy is a good thing. But unlike the global financial crisis, the Covid shock is also a structural or supply-side shock.

Drs Draghi and Yellen were successful central bankers. But their new roles require investing with urgency in a supply side agenda to strengthen the productive potential of their economies. The loose monetary policy they implemented gives them policy space they can use to progress these efforts.

And they should think small, learning from the experiences of small economies that have effectively navigated the challenges and opportunities of globalisation and technology.

For too long, large economies have moved slowly because their large markets buffer them from global competition. As Nobel Laureate Sir John Hicks once said, ‘the best of all monopoly profits is a quiet life’. But this quiet life is not available anymore.

Get in touch if you would like to discuss this analysis and its implications. I am also available for presentations and discussions on other global economic and political dynamics, and the implications for policymakers, firms, and investors. Do let me know if your organisation is interested in arranging a discussion.

Chart of the week

The European Commission released its Winter economic forecasts during the week. 2021 GDP growth was marked down, but 2022 was upgraded, meaning a faster overall recovery process. Most European economies will be above 2019 GDP levels by 2022, but with significant variation. Ireland leads, with good performance by the Nordics and Baltics as well. The UK, Italy, and Greece lag. The Commission estimates post-Covid growth rates lower than before 2020, suggesting some scarring.

Other writing

We prepare fortnightly Insight notes for clients on global economic, political and policy dynamics, and the implications for small advanced economies. Recent notes include:

§ Productivity renaissance in small advanced economies. There is a plausible case for a post-Covid productivity renaissance in advanced economies. Sustained investment in capital, technology, and new business models could lead to markedly stronger productivity growth. Small economies have particular exposures to these dynamics.

§ Post-Covid policy innovation in small economies. The structural changes generated by the economic impact of Covid-19 will require policy innovation across advanced economies. Although it is early days in the Covid policy response, there are some instructive features of the small economy policy response.

These notes and related services are available to institutions on a subscription basis. Contact me for more information on subscription options.

Around the world in small economies

Amsterdam overtook London as Europe’s largest share trading platform in January, with an outflow of equity trading activity post-Brexit. EU shares now need to be traded on EU-approved platforms, a status that London has not secured. Trading of carbon futures is also moving to Amsterdam from London in Q2. And Hong Kong had 4x the trading volumes of London over the past month.

Singapore’s Q4 2020 GDP growth came in stronger than expected, at -2.4% yoy and 3.8% qoq. Overall GDP growth for 2020 was -5.4%, and MTI forecast 4-6% GDP growth in 2021. The Singapore budget was delivered this week with heavy investment in both the short-term crisis recovery as well as structural adaptation initiatives.

The hard power of small economies: Denmark and Norway are investing more heavily in security in response to Russian aggression, with a new radar station in the Faroe Islands, drones for Greenland, and the reactivation of a submarine base in Norway’s north. And the Finnish Foreign Minister met with the Russian Foreign Minister this week, taking a more hard-headed approach than the EU Representative a couple of weeks back.

The Swiss National Bank now holds US$141 billion of equities on its balance sheet. These assets built up from exchange rate management have been invested heavily, earning sizable returns. However, these large holdings look small compared to the equity holdings of the Norwegian sovereign wealth fund, which is estimated to hold a 1.4% share of global equities.

A recent survey showed that Israel, Sweden, and Luxembourg were in the top 5 globally in venture capital funding per capita into AI (with Finland, Ireland, Denmark and the Netherlands also in the top 10). And Israeli start ups raised a record amount in January according to analysis from Start-Up Nation Central.

A small economy-heavy bloc to promote free trade in Europe has been established, mobilised by Sweden.

The New Zealand government is under growing pressure to address surging house price growth. Already at highly elevated levels, house prices rose a further 20% in 2020 on low rates, returning migrants, and a resilient economy. This is compounding a severe housing affordability issue. The government has committed to ‘bold’ policy action on housing over the coming months.

Dr David Skilling

Director, Landfall Strategy Group

www.landfallstrategy.com

www.twitter.com/dskilling