Small economies as 'canaries in the mine'

You can subscribe to receive these notes by email here

US equity markets hit record highs and European markets enjoyed a record November on growing confidence in the global economic outlook. The imminent deployment of vaccines, ongoing macro policy stimulus, and the incoming Biden Administration are all seen as positives.

But Covid-19 cases continue to accelerate in the US, much of Europe is in partial lockdown, and this week the OECD marked down its global growth forecasts for 2021 relative to the September forecast (from 5.0% to 4.2%).

So what to make of these conflicting signals? One useful place to look for a perspective on the global outlook is small advanced economies: the canaries in the mine of the global economy, because of their acute sensitivity to global conditions.

The short-term outlook

Small economy Q3 GDP growth has generally come in better than expected, continuing to out-perform most large advanced economies. This week, strong data from Switzerland, Austria and Belgium was reported.

Relative to Q4 2019, Q3 GDP was down just 2-4% in most small advanced economies. This suggests an underlying resilience of economic activity to the Covid shock.

The high frequency data (PMI, retail spending, mobility) indicate some weakening in momentum in several small economies due to the renewed lockdowns. But most of the components of the small advanced economy lead indicator that I prepare have been moving in the right direction.

The economic costs of the current lockdowns look to be materially smaller than in the initial wave of restrictions – and small economy Q4 GDP will likely be resilient.

Small economy equity markets are also pricing a more positive outlook. After moving in line with global benchmarks (ex-US) through 2020, small economy markets have responded positively to the stream of good news. Most small economy markets were up by more than the global benchmark in November. This is a positive signal on both the strength of small economies as well as on the global outlook.

This leads me to a more positive view on the economic outlook than in this week’s OECD forecast. Although not a V-shaped recovery process – most advanced economies will take until 2022 to recover to 2019 full year GDP levels – there is reason for confidence in the 2021 outlook. The unprecedented fiscal and monetary stimulus, more substantial than during the global financial crisis, will support this process.

However, there will be variation across countries. For example, the US faces significant health and economic challenges over the next several months, whereas much of Asia is better placed.

The IMF forecast a stronger economic outlook for small advanced economies over the next few years than for large advanced economies, which is consistent with a healthy global growth outlook.

This performance has been supported by the high-quality policy response to Covid-19, which has allowed most (not all) small economies to control Covid-19 as well as to manage the economic costs. This positions small economies for a strong recovery process as restrictions are relaxed.

Globalisation continues

This strong small economy performance has also been supported by resilient world trade growth. This matters because small economy exports are commonly >50% of GDP, and are an important driver of growth.

The external sectors (excluding international tourism) of small advanced economies have provided an important source of economic support. Indeed, small economy exports of goods and services have out-paced those of other advanced economies through 2020.

And growth in small economy exports of goods are in positive territory in the year to October. This international small economy experience is a positive sign on the health of the global economy.

The latest world merchandise trade data available shows an ongoing recovery after a slump in Q2. Forward looking indicators suggest this will continue. This rebound – V-shaped in nature – is happening much more quickly than after the global financial crisis.

The small advanced economy experience supports the claim that globalisation is changing, not reversing. Some types of flows are clearly down, such as international tourism and migration, with major implications for tourism-exposed economies (Greece, New Zealand) as well as hub economies like Dubai and Singapore.

But exports of electronics, advanced manufactures, pharma, and some commercial services, are growing. And trade agreements continue to be signed, most recently the RCEP agreement in Asia – as well as pioneering digital trade agreements signed by NZ, Chile, and Singapore.

There may be new frictions on supply chains and people flows, but small economies show that externally-oriented growth models continue to work.

Believe (some of) the hype

Equity markets may be getting a bit ahead of themselves, but the small advanced economy experience supports a positive assessment of the global economic outlook. And over a slightly longer time horizon, a case can be made for a looming productivity renaissance.

As the world pivots from crisis management to addressing the structural dynamics accelerated by Covid-19, the policy innovation underway in small advanced economies also provides guidance. Small economies have a record of agility and creativity in responding effectively to structural changes in the global economy, and provide a sense on how to come out of this crisis stronger.

Get in touch if you would like to discuss this analysis and its implications. I am also available for presentations and discussions on other global economic and political dynamics, and the implications for policymakers, firms, and investors.

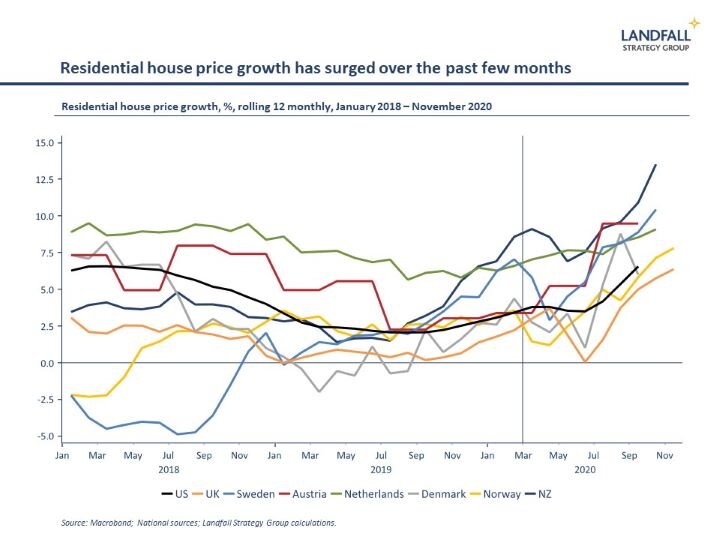

Chart of the week

Residential house prices are surging despite the economic shock, a markedly different profile than during the global financial crisis. Low interest rates combined with upgrading demand (because people expect to spend more time at home), and macro stimulus that has buffered the labour market shock, have led to strong acceleration in residential house price growth after a pause in Q2. This is particularly true in many small economies, notably New Zealand and Sweden.

Small economies around the world

It is proving difficult to open up borders to travel, even for countries with good Covid outcomes. The Hong Kong/Singapore air corridor was postponed shortly before it was due to open because of a spike in cases in Hong Kong, and is now scheduled for 2021. And the trans-Tasman bubble remains a way off. Perhaps New Zealand and Taiwan would be a lower risk option.

In response to surging house prices in New Zealand (from already high levels), the Minister of Finance sent a letter to the (independent) Reserve Bank to ask that they consider how to add house prices into their mandate. They responded that they already do so; although New Zealand’s macroprudential policy measures have been less aggressive than in economies like Singapore. The government has ruled out other policy measures such as a capital gains tax.

The Baltic states have done relatively well in responding to Covid-19. Although Lithuania is experiencing a pronounced second wave of infections at the moment, it is forecast to have one of the smallest GDP contractions across the EU this year. And the migration outflows have reversed, in a similar way as in New Zealand.

Greece continues to track positively, with a reforming government. The Eurogroup has just approved a further tranche of debt relief. Although Greece has been hit hard by the loss of international tourism, it is well-placed to recover as demand returns. It has announced measures to attract high-skill migrants, is attracting FDI (e.g. Microsoft), and has the start of a vibrant high-tech cluster.

Small economies speak very good English, according to a recent measure. The 2020 edition of the English Proficiency Index ranks the Dutch in top place, followed by several Nordics. This helps with international engagement by people and firms.

Sweden has been in the news for its liberal approach to Covid-19. It has been at the top end of the Nordic group for infections and deaths. One consequence is reducing life expectancy. Although Sweden has been one of the better-performing advanced economies through 2020 (GDP is down by ~3% since Q4 2019), the Riksbank has announced more expansionary monetary policy to provide additional support to the Swedish economy.

The annual Hong Kong policy address by the Chief Executive was delivered after a month’s postponement. The major focus was on integrating with China (capital markets, infrastructure), with not much on domestic policy reform. There were commitments to build more public housing but no plans for further stimulus spending (despite a major economic contraction and large financial reserves). Carrie Lam also said that the national security law has been ‘remarkably effective’.

You can subscribe to receive these notes by email. And feel free to share this with anyone that may be interested.

Dr David Skilling

Director, Landfall Strategy Group

www.landfallstrategy.com

www.twitter.com/dskilling